Confronting Mexico’s New Black Market in Fuel Theft and Trafficking

Inaction in politics can be comfortable. Politicians might opt for hand wringing to avoid confronting the consequences of their actions, or, in the worst-case, to hide their own complicity. Mexico´s new administration has been in the headlines recently for doing just the opposite: On December 27th of last year, president Andrés Manuel López Obrador announced that his government would confront the large-scale theft of fuel that affects Petróleos Mexicanos (PEMEX). Since then, there have been widespread news of lines and fuel shortages. The situation escalated further on January 18 with the horrific news of 73 people killed and another 76 gravely injured from the explosion of a fuel pipeline in the state of Hidalgo. Mexico´s New Black Market What the …

A Public Private Partnership for Iran’s New Petroleum Contract?

Now that sanctions against Iran have been lifted, the country has significant opportunities to boost its investment levels. Still, Iran’s leaders have to address a range of issues before this can be done effectively. Can a public-private partnership provide a solution for the financing of energy infrastructure projects, at a time when Iran is facing declining revenues as a result of years of crippling sanctions? Now the sanctions lifted, political risk disappears, the country offers significant new opportunities for foreign investors: economic attractiveness, greater moderation, and horizontal market integration. Iran’s New Contract Model Iran will present its new oil contracts during a scheduled conference in February 2016 in Tehran. By 2020, the country hopes to increase crude production to about …

Should America Care About Energy Independence?

For the past forty years, the United States has been dependent on foreign oil. In the early 1970s, declining domestic production and America’s ever increasing thirst for oil made dependency on imports a necessity, whilst the OPEC Revolution and the 1973 Arab oil embargo seemed to also make dependency a serious threat to national security. Beginning with the formulation of Nixon’s “Project Independence”, the US has sought to reverse this worrisome position and restore what is usually imagined as a quasi-paradisiacal state of nature: energy independence. Yet, while president after president emphasised the importance of tackling the problem, US net oil imports kept rising, until they peaked in 2005 at about 12.5 million barrels of oil per day, 65% of …

Oil wealth after the Arab Spring: A trillion-dollar catalyst for change

At the end of the 19th Century, Lord Curzon, the then British Viceroy of India, described Iran and its Arab neighbours as “pieces on a chessboard upon which is being played out a game for the domination of the world”. The geostrategic importance of the Middle East, with its immense oil wealth, has shaped the policies of colonial empires, secured the longevity of autocratic regimes and given rise to religious elites. The ‘game of chess’, as described by Lord Curzon, promises great riches and influence for the players involved, but has often come at a huge cost for the majority of the Arab people. Indeed, oil wealth, so narrowly shared between the region’s ruling minorities, has historically presented a barrier …

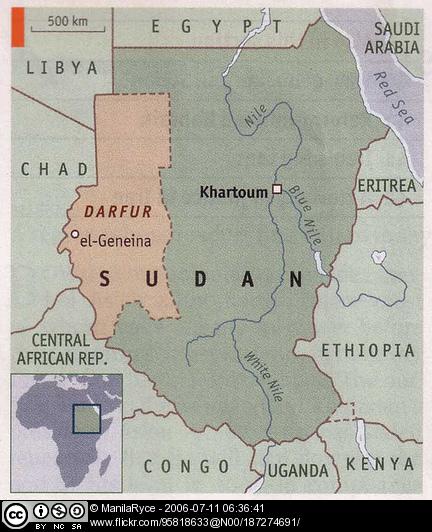

China and India in Sudan: an Uncertain Relationship

On June 21, at the Manor Road Building, Oxford University, Daniel Large and Luke Patey discussed the role of China and India in Sudan’s oil sector. This industry is of particular interest today, as on the 9th of July the country will split into Northern Sudan and Southern Sudan. The recent border clashes illustrate the lack of agreement between the two sides about the sharing of oil revenues. The two speakers situate this issue within an international context by contrasting the involvement of China and India and discussing the long-term prospects of Sudan’s oil industry, among other interesting questions. China’s involvement in Africa has become a hot topic in media and political discussions. This has concealed that of other Asian …