Dear Prime Minister – it’s time to do much, much more to help Europe’s refugees

In a letter published in The New Statesman, a number of Oxford academics argue that the current government position is bad policy, bad politics and a betrayal of a proud British tradition. Dear Prime Minister and Home Secretary, We the undersigned are dedicated to creating a socially just world. We spend our working lives supporting and promoting research, initiatives, and projects which will create a fairer and more equitable society for everyone. Among our number are many leading experts on community cohesion, asylum, refugees, migration, politics, public opinion, policy and law. We believe the Government’s current position on the European refugee crisis is misguided and requires urgent change. Britain has a long and proud tradition of providing sanctuary to those in …

Magna Carta: a beggarly thing, a mess of pottage

That in 2015, we still commemorate an agreement between the king and the barons of England reached 800 years ago, probably on the 15th June 1215, is a cause for wonder. Magna Carta, the Great Charter, as that agreement has come to be known, is held to be a milestone in the course of western constitutional thought. Its place in English jurisprudence is secure, but, while prominent, hardly matches the reverence it is shown on the other side of the Atlantic. Among the range of subjects covered by Magna Carta, three stand out for their constitutional importance: liberty, the rule of law and due process in the administration of justice, and taxation. On liberty: Chapters 39 is most famous in protecting liberty from arbitrary arrest and related …

A Magna Carta for learning disabled people

800 years of Magna Carta but learning disabled people remain ‘villeins’, denied rights against arbitrary power. What would a Magna Carta for learning disabled people look like? Who are the ‘villeins’ today? No free man shall be seized or imprisoned, or stripped of his rights or possessions, or outlawed or exiled, or deprived of his standing in any other way, nor will be proceed with force against him, or send others to do so, except by the lawful judgement of his equals or by the law of the land. To no-one will we sell, to no one deny or delay right or justice. 800 years ago this set of freedoms was made law. Although Magna Carta is widely believed to have been …

‘English Votes for English Laws’ — a viable answer to the English Question?

Last week the government published its detailed proposals for introducing English Votes for English Laws (EVEL) into the House of Commons. This is a significant moment in our constitutional history primarily because these changes reflect the acceptance of the need to institutionalise a collective English interest in the legislature, and the conviction that there is a growing and legitimate sense of grievance concerning England’s position within the UK. The primary rationale offered for introducing EVEL is to bring Westminster up to date with the implications of devolution elsewhere within the UK. In a context where further devolution is anticipated for Scotland, Wales and Northern Ireland, it is becoming harder to ignore demands that English interests be given greater consideration in parliament. The …

Digital Rights and Pornography – A child protection catch-22 or lazy policy solutions?

Our rights are being infringed more and more on every side, and the danger is that we get used to it. So I want to use the 25th anniversary for us all to do that, to take the web back into our own hands and define the web we want for the next 25 years…. “But we need our lawyers and our politicians to understand programming, to understand what can be done with a computer.[1] – Sir Tim Berners-Lee The above quote should come as no surprise to anyone with even a passing interest in digital rights. In recent times there has been growing interest by governments in how to respond to the sort of modern social problems that …

Pornography and digital rights

One of the Internet’s most awe-inducing features is its ability to serve up whatever piece of content you need, whenever you need it. Whether you’re looking for videos of cats riding Roombas, the translated poetry of Goethe or the song of a nightingale, the Internet, thanks to the incredible resources of the World Wide Web, will dish up whatever you’re after. Of course, insofar as online content mirrors our offline imperfections, it’s equally easy to find less salubrious material. As with many other technologies before it, the Internet has provided a new platform for pornographic content, and whatever your sexual predilections, you will find an ample store of online content to meet every desire. Unsurprisingly, this leads to no small …

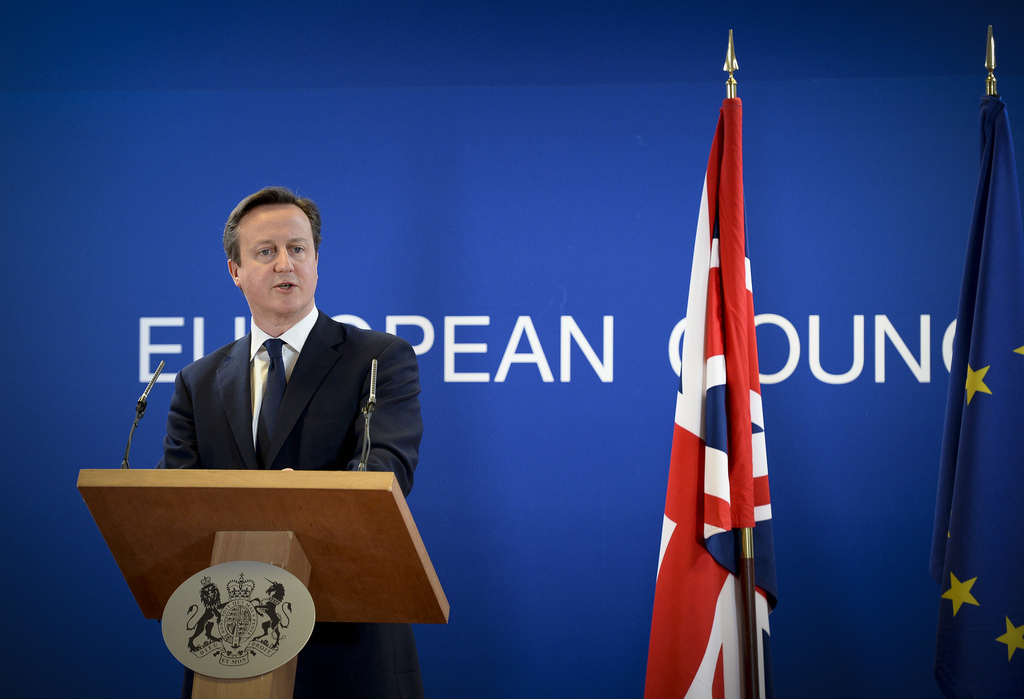

The referendum on EU membership: a very British affair

The UK referendum on EU membership may be many months away but with David Cameron laying out his stall with other European leaders, we should be clear that we are embarked on the journey and already some way down the track. It is easy to think of referendums as one-shot deals but in reality they are not. Rather, referendums are long-term games and in this case the game was started in 2013. And it’s easy to think of this as a European process, but whatever grand meals may be consumed in other European capitals, this is very much a result of domestic British politics. The EU referendum is largely down to domestic drivers and the result will likely be shaped as much by the party politics between and within UK parties as by European factors.

Why Scotland should adopt the Land Value Tax

The Commission on Local Tax Reform was set up by the Scottish government in February 2015 to consider reform of local government taxation. In this article, submitted as written evidence to the Commission, I make the case for a land value tax (LVT).

1. Local tax should be based on…

The value of the land you own. This is for reasons first set out by Adam Smith in Wealth of Nations (WN) Book V. I am pleased that the Cabinet Secretary for Finance referred to this in his speech introducing Land and Buildings Transactions Tax (LBTT).

A land value tax is the best of all taxes for three reasons.

Land doesn’t move and can’t be hidden.

Land tax best satisfies Smith’s canons of taxation (proportionate to benefits received; certain; convenient; non-distorting – see Wealth of Nations, Book V.ii.b)

It taxes ground-rents, which Smith calls ‘a still more proper subject of taxation than the rent of houses’, because ‘no discouragement will thereby be given to any sort of industry’.