Most governments know a lot about their debt but little about their assets. In the wake of the 2008 financial crisis, as governments mobilized to manage their public debt, they largely ignored their public assets. Some countries, such as the Baltic states and Portugal, took steps to appraise their wealth, but most did not. The United States, for example, chose not to participate in a 2011 initiative by the Organisation for Economic Cooperation and Development (OECD) to evaluate the size and composition of state-owned firms in member countries.

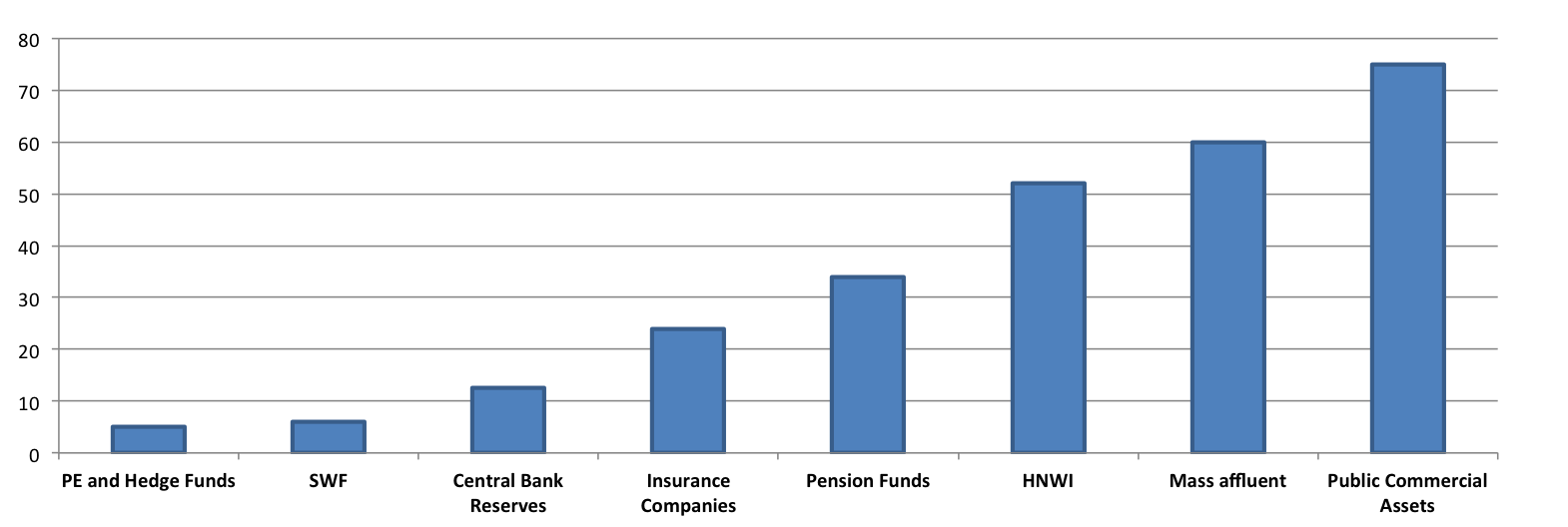

But a better understanding of public commercial assets — defined as government property that generates profit, such as state-owned firms, real estate, and forests — could help yield significant amounts of wealth for economies struggling to get back on track. According to our calculations, which draw on data from the International Monetary Fund (IMF) and other public sources, central governments hold significantly more commercial assets than private equity firms, hedge funds, pension funds, sovereign wealth funds, or the super-rich (see figure 1 below). The value of public commercial assets is on the same order of magnitude as annual global GDP, and comfortably higher than global public debt. If central governments managed their assets better, they could generate annual returns of roughly $3 trillion, or more than the world’s yearly investment in infrastructure including transportation, power, water, and telecommunications.

On average, however, governments are mismanaging their public assets. Although there are a few examples of well-run state-owned firms, for instance, Statoil in Norway, or partially state-owned firms such as Deutsche Post in Germany, most earn lower returns than their privately owned counterparts. Most state-owned companies — such as the oil giant Petrobras in Brazil, state-owned banks in India, and state-owned enterprises in China — are wasteful and corrupt of which I give ample evidence in my book, The Public Wealth of Nations (co-authored with Dag Detter). Other types of public commercial assets, such as real estate, perform even worse.

Many economists see these inefficiencies as arguments in favor of privatization. But privatization comes with its own risks: crony capitalism, corruption, and dysfunctional regulation. Luckily, there is a third way: governments can assign the task of professionally managing their assets to National Wealth Funds (NWFs).

National Wealth Funds are the perfect compromise: they keep public assets under government ownership while simultaneously preventing undue government interference. NWFs are quite different from Sovereign Wealth Funds (SWFs), even though both are state-owned and managed at arms length from the state. Where an SWF is primarily a fund manager investing liquid financial assets of the state (e.g. Singapore’s GIC), an NWF is akin to an investment company in charge of active corporate governance for the commercial, operational assets of the state such as state-owned enterprises, real estate, forests, infrastructure as a portfolio (e.g. Singapore’s Temasek). Thus NFWs and SFWs require completely different skills.

The state appoints the auditors responsible for the portfolio and decides which assets should be sold when sufficiently developed, but it cannot influence how the fund itself is managed. This strict separation guarantees that politics will not get in the way of good asset management. When governments control public commercial assets, opportunities for better management are ignored or fall prey to political meddling, clientelism, and corruption.

National Wealth Funds also enable governments to consolidate their commercial assets, which allows managers to create an integrated inventory and business plan for the assets as a whole. The world’s leading NWF, Singapore’s Temasek, established in 1974, boasts an average annual return of 17 percent, a track record that would be impressive even in the private sector. Another successful fund, Austria’s Österreichische Industrieholding AG, established in 1946 to nationalize Austrian industry, became an independent holding company in the 1970s to prevent undue government interference. With politicians explicitly banned from the board, the fund has performed better than the Austrian stock market index ATX and pays considerable annual dividends to the Austrian government.

In recent years, more than a dozen other countries have established their own NWFs. For example, Finland created Solidium in 2008, and Vietnam created SCIC in 2005. Although it is still too early to evaluate their success, it is likely that the success of funds such as Temasek and ÖIAG will encourage governments to give funds control of even more assets, such as real estate. In recent years some countries such as Sweden have consolidated state-owned real estate in holding companies with a mandate for active governance. The next logical step would be for governments to create similar funds at the regional and local levels, where there is an even larger concentration of assets.

Even if governments do not immediately establish National Wealth Funds, they should at least start treating their public assets as listed companies. Countries such as Austria, Finland, Singapore, and Sweden, for example, publish annual reports detailing the value, yield, and performance of government-owned enterprises. But they are exceptions. The vast majority of countries keep such information hidden, if they have collected the data at all. In the absence of reform, such countries will be forced to rely on tax increases or cuts to public expenditures to restore their public finances to good health.

This article is part of a blog series building on three seminars co-hosted by Oxford’s Department of Politics and International Relations, the New Economics Foundation and Positive Money.

This blog series aims to inform public and policy debate on the role of public assets in our political economy. The series and related seminars were supported by the University of Oxford’s ESRC Impact Acceleration Account.

The Public Wealth of Nations

Stefan Fölster is adjunct professor at the Royal Institute of Technology and chief economist at the Confederation of Swedish Enterprise (Svenskt Näringsliv).

Stefan Fölster is adjunct professor at the Royal Institute of Technology and chief economist at the Confederation of Swedish Enterprise (Svenskt Näringsliv).

This article draws on his book “The Public Wealth of Nations: How Management of Public Assets Can Boost or Bust Economic Growth“ (Palgrave Macmillan). The book is coauthored with Dag Detter and was included in the Financial Times’ and the Economists’ best book of the year 2015 list.