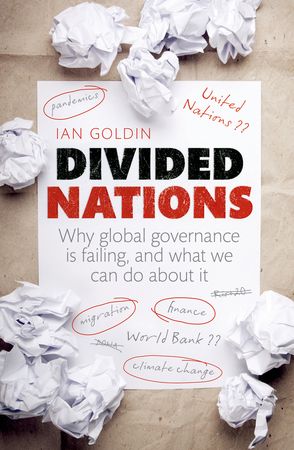

Divided Nations: Why global governance is failing, and what we can do about it

The growing disconnect between the problems that bind us and the countries that divide is the greatest threat to humanity. Each day we are confronted by mounting evidence of the yawning governance gap. Recently, British people have been surprised to find their meat has been through the mincer of multiple legal jurisdictions through which beef has been blended with horse. Russians have been shocked by a meteorite that crashed unannounced into their territory, due to the failure of global coordination of space. In Tokyo, a bluefin tuna was auctioned in Tokyo for USD$1.7 million, raising concerns globally that market signals may be hastening the extinction of rare tuna. And in the United States, Hurricane Sandy’s impact on lower Manhattan and the New Jersey shore has raised interest in the work of scientists who identify freak storms as an early warning of climate change. Meanwhile, across Europe the aftermath of the financial storm continues to destroy jobs and livelihoods.

Social democracy must radicalise to survive

Social democracy seems perpetually at a crossroads. But today, more than a hundred years after the first of the parties affiliated to the Second International won a plurality in a parliamentary election (in Finland in 1907; Anderson, 1992, 307), social democrats may finally be running out of rope. All the main European social democratic parties are facing a crisis, registering at long last endlessly postponed questions about their fundamental purpose.

Rawls on Wall Street: comparing his theory of justice to economic liberal theory

In terms of the financial crisis, there are fascinating links between the Rawlsian theory of justice and the economic liberal theory which has drawn criticsm for failing to predict the crash. For Rawlsian adepts: this is not an attempt to apply Rawls’ theory of justice to explain the current economic crisis. It would not be suited to do so and neither was it designed to do so. But highlighting these links may teach us a thing or two about both endeavours and also give us pause about the Rawlsian project itself. Much (too much?) has been written about Rawls, both in defense of his project and against it. Those in disagreement generally use one of two strategies: attack the …

The beginning of the debt crisis: Europe and beyond

Government debt is a burgeoning issue, but the solutions are thus far a damp squib. Despite claims otherwise, the debt crisis is not one that has been solved – not even partially. Recently, European leaders saluted an agreement on settling part of Greece’s outstanding debt– largely by canceling it. Yet, European governments have merely found a way to roll debt over, with debt levels scheduled to increase further, at least until 2016. Interest rates on government bonds should increase correspondingly – hence the rating agencies’ downgrades. Unless we encounter solid growth throughout Europe, we are heading toward further turmoil. Far from attempting to be pessimistic, I solely seek to reflect on the reality of the situation and what it may entail for the future. What leaders haven’t …