The Political Dynamics of Myanmar Facing the International Court of Justice

On the 12 December, 2019 the International Court of Justice (ICJ) concluded its public hearings on the request for the indication of provisional measures submitted by the Republic of The Gambia in the case of the application of the Convention on the Prevention and Punishment of the Crime of Genocide (The Gambia v. Myanmar). The case is the first of three cases against Myanmar in a move to hold the country accountable for the atrocities committed against the Rohingya minority in Rakhine State since August 2017, which drove 730.000 into neighbouring Bangladesh. The International Criminal Court launched an investigation into the persecution of the Rohingya on 14 November while a separate case under the principle of universal jurisdiction was filed in Argentina. For the …

What International Relations theory can tell us about NATO’s ‘mort cérébrale’

In the prelude to the NATO summit in London commemorating the 70th anniversary of the founding of the alliance, discussions were overshadowed by a now-infamous Economist interview with French President Emmanuel Macron. In the interview, the French President claimed that NATO is experiencing a “brain death” – a ‘mort cérébrale’ resulting from a lack of institutional capacity to prevent, mitigate, or effectively respond to unilateral action from individual allies which could be disruptive to the alliance’s agenda. President Macron’s remarks precipitated a debate concerning NATO’s relevance (or irrelevance) in the post-Cold War international system, its (potentially failing) adaptation to new security and strategic circumstances, and the constraints imposed by NATO’s seeming lack of institutionalisation and ability to prevent unilateral action …

‘You did not act in time’: Greta Thunberg and behavioural contestation

‘Basically nothing is being done to halt — or even slow — climate and ecological breakdown, despite all the beautiful words and promises’. Greta Thunberg’s damning speech before the UK parliament last month highlights that the greatest challenge to international climate agreements is inaction by governments. The Swedish climate activist’s central message was: ‘You did not act in time’. The norms within the Paris Agreement on climate change are challenged not just by climate change deniers and other open critics. Perhaps more dangerously, as Thunberg pointed out, they are also contested by states like the UK that pay lip-service to the agreement but fail to reach their emissions reduction targets. To capture these diverse forms of norm contestation, a collection of articles on ‘The dynamics of dissent’ in …

NATO, the Russian threat and defence spending

As expected, the recent NATO Summit was dominated by President Trump’s blunt criticisms of allies. He accused European member states of taking advantage of the United States, of failing to follow through on the 2014 agreement to raise defence spending to a minimum of 2% of GDP, and cozied up to Russia, perhaps most shockingly given the accusations levelled at his own campaign, of colluding with Russia. The basis for these accusations should be taken seriously, even if the latent threat of the United States withdrawing from NATO and the capricious means of delivery seem designed more to appeal to American domestic political interests than to truly illicit reform of the organisation. Cutting through the hyperbole, we see that there …

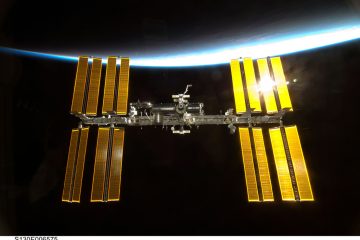

The Interplay between Outer Space Security and Terrestrial Global Security

US president Donald Trump recently announced the establishing of a “Space Force,” a new branch of the military to project US military might into outer space. In doing so, he followed up on his March 2018 statement that his administration “recognizes that space is a war-fighting domain, just like the land, air and sea.” While such ideas are neither wholly new nor exclusively held by president Trump, they seem to challenge the fundamental principle of outer space as a global commons, which was enshrined in the 1967 Outer Space Treaty. Questions of outer space security are not just important for their own sake, as this article will show, they have wide-reaching implications for global security. Global security and space security …

Just Power for a Reformed UN

The UN secretary-general began his mandate in January 2017, renewing hope about the organization’s reform. Repeated failings of the UN Security Council during various conflicts like the Palestinian issue or the Syrian conflict are sharp reminders that the United Nations simply is not delivering on its aims of global peace. Reforms must consider justice and dignity, both of which have strategic relevance for powerbrokers with the all-encompassing connectivity of the contemporary world alongside heightened attention to values, reputation and credibility in terms of legitimacy and regard for human rights. The merits of the UN in global governance should not be understated. A wide range of contemporary challenges – from climate change to terrorism – cannot be adequately addressed unilaterally or …

On the Margins: Meetings to Watch at the Hamburg G20

Summits are not just — or even mostly — about what happens in the formal leaders’ meetings. What happens on the sidelines often has the largest effect on steering the course of international politics. This is the first year that the G20 summit could end up as a failure, advancing little in the way of substantive progress on the global governance agenda, chiefly owing to the group now having to contend with Donald Trump taking America’s seat at the summit table. Trump’s ‘America First’ agenda — typified by its economic protectionism and rejection of the established multilateral order — is entirely antithetical to the G20’s previous commitments to reject protectionism and safeguard the liberal, rules-based, multilateral governance order. This year’s G20 …

Four Lessons from Brexit and its Fallout

There is no shortage of lessons to be learned from Brexit and its fallout – for politicians, businesses and the public alike. For strategists, analysts and advisors, these past few weeks have provided a host of examples of both good and bad practice. Surveying recent events, four take-aways stand out: 1) Forecast, don’t predict No one predicted this. Nor did the polls or the betting markets. Even the leaders of the Leave campaign did not predict Brexit. More than this, though, no one predicted that within weeks of a vote all of the Leave campaign’s victorious leaders would have resigned from the field and a new Prime Minister (who supported Remain, however quietly) would be installed in Downing Street. Polling …